Summary

- The Federal Reserve is nearing a decision to increase the discount rate.

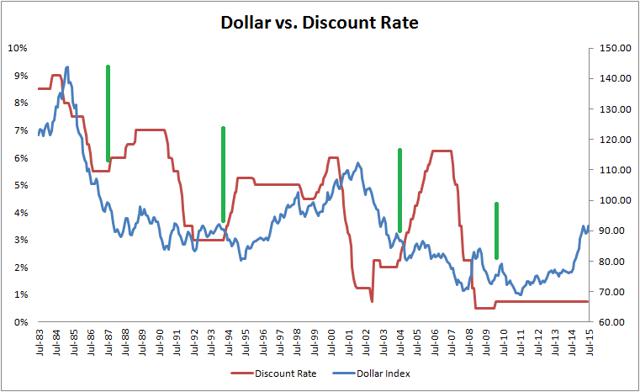

- As the discount rate rises, the dollar index declines by 8-12% historically.

- When the dollar falls, gold rises - it's time to buy gold.

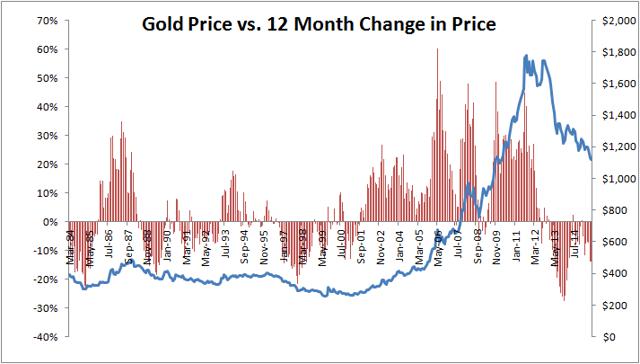

The last year has witnessed a traumatic meltdown in the price of gold (NYSEARCA:GLD). From its peak in 2011, gold has fallen over 30%, with decreases in nearly every quarter.

For the passionate long only gold bugs, there is hope however. New changes in the Federal Reserve's discount rate will reverberate through global markets and more than likely increase the price of gold.

Since the financial crisis, the Federal Reserve has only altered its discount rate once. The discount rate is essentially the true risk-free rate of return for the United States economy. Nearly all other interest rates are based on a proxy to this rate. As the discount rate increases, so increases the rates of almost everything else in the economy. In other words, the discount rate is very important.

Perhaps what has most been overlooked in the recent financial media is the clear relationship between the discount rate and the dollar index.

When the Federal Reserve increases the discount rate, the dollar tends to decline in value. This is an important concept to grasp. Since the discount rate is the bedrock of interest rates, all projects and investments which corporations pursue will be evaluated against this rate. When the discount rate is low, companies are able to pursue projects which offer relatively small return, provided the return is greater than the discount rate. However, when the rate increases, companies are forced to trim back investments and only focus on projects which offer higher returns. When companies pursue fewer projects, there is less demand for dollars, and the currency weakens.

The Federal Reserve is about to increase the discount rate for the first time in several years. Every other time in the past that the Federal Reserve has done this, the dollar has proceeded to decline by 8-12%.

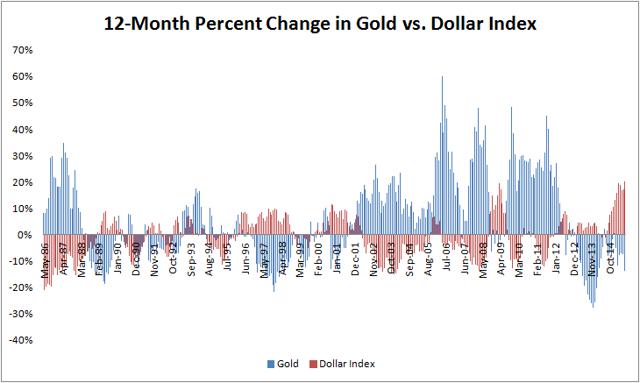

"So what's this have to do with gold?" Thank you for asking! You see, in today's capital markets, everything is interconnected. As the dollar falls, basic economic theory says that it will take more dollars to purchase the same basket of goods. In other words, as the dollar weakens, it will take more dollars to purchase the same ounce of gold, and the price of gold will rise. Economic theory is all fine and dandy, but I really like to see it in the data.

As the chart above shows, a strong relationship exists between the strength of the dollar and the price of gold. As the dollar declines, the price of gold strengthens. This is simple, logical, and gives an investment edge.

Much of success in investment lies in the ability to understand and exploit a given piece of data better than the average market participant. At present, very few people know or care that when the Federal Reserve increases rates, the dollar has fallen every single time. The market's oversight is our profit. When the Federal Reserve increases rates in the near future, the dollar will more than likely weaken. The data strongly indicates that when the dollar weakens, the price of gold rises. So how do we profit from this? Buy gold.

--

Happy Investing.

BLOGS : http://investbourses.blogspot.com , http://investbourses.wordpress.com,

Twitter : Investbourses, Facebook : Inv Bou

Note- Members express their own view & may be or may not be having investment or speculative positions in the commodity, please do not take it as buy or sell advise, please use your own judgments for buying or selling, after having discussion with your certified investment brokers or the person to whom u have good level of confidence. once sentiment is changed from good to bad no good news work but bad news do work, investors must keep this in mind.NEW INVESTORS SHOULD BE VERY CAREFUL.

No comments:

Post a Comment