GOLD ANALYSIS

Gold has tracked its seasonal pattern very closely this year, and indications are it reached a low during July. Traditionally, August is an excellent time to buy gold.

Author: David LevensteinPosted: Monday , 24 Aug 2009

JOHANNESBURG -

Gold began the last week with considerable downside pressure as bearish news filtered through the markets. There was a massive short position from the bullion banks, JP Morgan and HSBC and a report from the World Gold Council. According to the report gold demand fell to a six-year low in the second quarter as recession curbed buying by jewelers and electronics producers. The report also stated that global consumption fell 8.6% to 719.5 metric tons from a year earlier. That's the lowest level since the first quarter of 2003. Jewellery demand declined 22% and electronics, the biggest industrial use for gold, slid 26%. Rozanna Wozniak, investment research manager at the council said, "Tough economic conditions have impacted jewellery and industrial demand. Investment demand provided a cushion and we do expect that to continue."

In India, the largest buyer, gold demand fell 38% to 109 tons, while it rose 11% in China, the second-biggest buyer, to 89.6 tons, the World Gold Council said. Germany was the biggest investment market with demand of 28 tons, compared with 23 tons in the U.S. and 21 tons in India, the report said.

Gold is, however, turning out to be a major investment avenue for Indian investors. Despite high local prices, dollar volatility and fall in general demand for jewellery, retail investment demand for gold has seen a sharp upswing.

Retail investment demand in India returned to positive levels after seeing slack demand in the first quarter, but was nevertheless weak in comparison to the year-earlier totals. The demand for bars and coins was 21.0 tons compared to 48.1 tons recorded in Q2′08. Experts said despite the recent near record rupee prices, investor appetite and consumer affinity for gold remains healthy.

China's gold market exhibited a "unique resilience" according to the World Gold Council in the face of the pressures of the global economic recession. Mainland China's jewellery demand rose 6% year on year in the second quarter, the only major jewellery buying nation to record a positive rate of growth in volume, while investment demand remained relatively stable. Rozanna Wozniak, the WGC's investment research manager said, "China's cultural affinity to gold may not be quite as strong as it is in India, but gold ownership is nevertheless a key part of the wedding season, gifting season and process of wealth protection and accumulation," said Ms Wozniak.

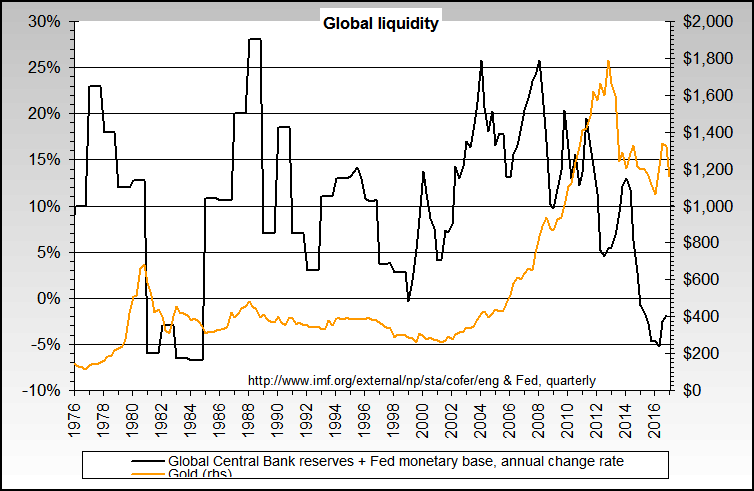

The WGC said China could overtake India as the world's largest gold consumer within the next 10 years, or even as early as within the next five years. Gold only accounts for 2% of the total reserves held by China's central bank. If China's reserves continue to grow rapidly, more gold would be required just to maintain a constant proportion. It is no secret that China is the largest holder of US government bonds and more than once, they have expressed their concern about the value of the dollar. I believe that China will continue to diversify some of its reserves into gold.

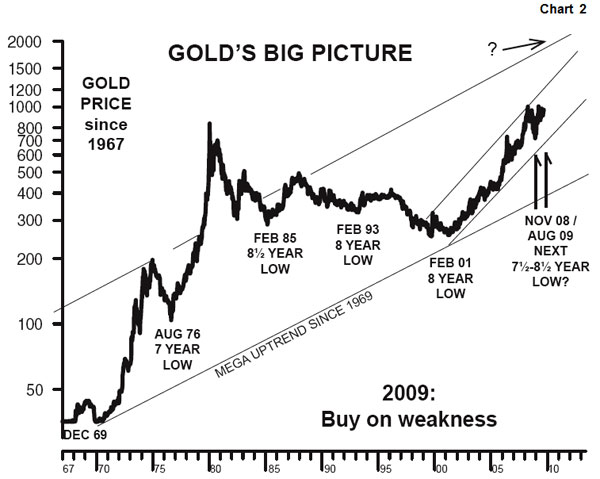

While there are no guarantees that seasonal patterns recur every year, gold has tracked its seasonal pattern very closely this year, and I believe that it has made it's low during July. Traditionally, August is an excellent time to buy gold.

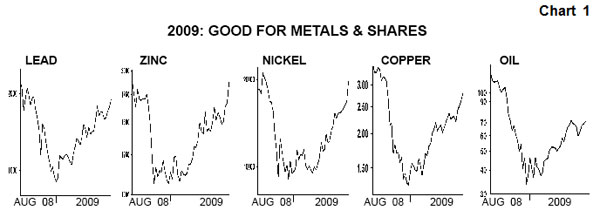

By the end of the week, we saw a drop in the value of the US dollar against the Euro, Nymex October oil jumped some US$7 from US$66 to US$74, and as to be expected gold shot upwards and at one point Dec gold touched $960.

Technicals

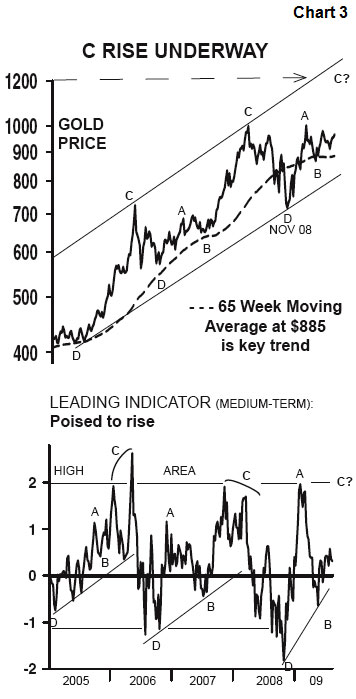

Gold is forming a right-angled triangle with a resistance level at the US$960-US$965 level. The seasonal lows during the July/August seem to have already occurred in July when it touched US$905 and I am now looking for a break above US$960 in the short-term.

While I have never advocated switching your entire assets into gold or any other asset for that matter, gold is the ideal diversifier for a stock portfolio. Although the price of gold can be volatile in the short-term, gold has maintained its value over the long-term, serving as a hedge against the erosion of the purchasing power of paper money. Gold is an important part of a diversified investment portfolio because its price increases in response to events that erode the value of traditional paper investments like stocks and bonds.

Thanks,

Commodity Daily

You received this message because you are subscribed to the Google Groups "Commodity Daily" group.

To subscribe visit link http://groups.google.com/group/commoditydaily/subscribe

To unsubscribe from this group, send email to commoditydaily-unsubscribe@googlegroups.com

http://commoditydaily.i8.com and http://commoditydaily.blogspot.com

NEW INVESTORS SHOULD BE VERY CAREFUL.